For many years, accountants and CPAs were at the mercy of spreadsheets and isolated on-premises tools. For CFOs working on budgets or CPAs struggling to keep clients in the loop, collaboration could be cumbersome and slow. Even once online tools entered into the scene, concerns about the safety of the cloud for such sensitive information meant that executives and accountants were slow to champion their adoption. Regulatory concerns, compliance requirements, and security are always crucial issues for financial professionals, and it took widespread acceptance of rigorous protocols such as the CloudTrust Protocol (CTP) from the Cloud Security Alliance and then cloud-based accounting and financial tools began to blossom. These applications have now moved into the mainstream, and they blow your average spreadsheet under the water. We’ve taken taken a comprehensive look at the best tools out there for CPAs, and what they can do for your business.

1. Xero

Xero creates “beautiful accounting software” for companies themselves and for the financial professionals who serve them. Xero’s tools facilitate online invoicing and expense tracking, and cut down on data entry with automatic fetching and reconciliation with online accounts. Collaboration between accountants and clients is easy, with a simple drag-and-drop interface for file sharing and collaboration, and the facilities you need to create beautiful sharable reports.

2. Expensify

Expense tracking, capture, approval, and processing with features like smart auto-categorization, automated rule-based approval workflow, report histories with digital signatures and audit trails, mileage tracking, and billable hours logging. Also included are nifty travel-friendly tools like real-time flight updates. Expensify offers a specific partnership option to accountants and consultants.

3. KashFlow

To properly serve your business or your clients, you need a firm grip on all of their financial data. KashFlow’s partner program allows accountants to set up and customize bookkeeping accounts for each client, and access those accounts securely from any device. Tightly integrated with Excel and Quickbooks, KashFlow makes it simple to automate common financial and accounting tasks, including quotes, estimates, invoices, and payments.

4. Replicon

Timesheets, payroll, and expense management are all easily handled with this suite of fully-mobile tools. The TimeCost tracker has special relevance for companies who may be eligible for government tax credits, allowing easy verification and documentation for reporting and compliance purposes. All the Replicon products sync beautifully with major accounting software for seamless integration.

5. Abacus

This brilliant app seeks to make expense reports a thing of the past. It allows employees to record expenses in real time and receive reimbursements right into their bank accounts within 24 and 48 hours. It also automatically reconciles corporate cards. Intuitive for employees, managers, and accountants alike, it completely streamlines expense management. Abacus syncs nightly with your accounting software and provides a full audit trail, long-term data access, and full data portability.

6. Certify

With the most positive reviews of any expense management tool, Certify is rapidly gaining popularity. It instantly automates expense reports by pulling data from receipts using a smartphone, also analyzing e-receipts. It has been built with tight integration for many accounting and management products, and also provides a rich stream of data and analysis to help identify trends and optimizations.

7. FileThis Pro

FileThis began life in 2014 as a consumer-facing product for people who wanted to go paperless, but the Pro version adds a wealth of functionality for financial professionals. This fully automated document collection service pulls statements, receipts, bills, invoices and tax documents from clients’ online accounts to create a searchable PDF file in a central location which can be securely accessed. Bank level 256-bit SSL encryption and physically patrolled US servers keep everyone’s data safe and sound.

8. Fathom

Go beyond bookkeeping into true financial intelligence, with Fathom, which offers a host of deep insights into a company’s performance and cash flow. Fathom turns accounting data into accounting analysis, with a beautiful dashboard, powerful analytics, rich reporting features, alerts, and more.

9. Spotlight Reporting

Another tool with a dedicated partnership track for advisors and accountants, Spotlight reporting bills itself as a “virtual CFO”, and it actually delivers. Management reporting from is intuitive and accessible through Spotlight Reporting’s suite of tools. Their reporting facilities include measurements of financial performance, position, cash and write up, as well as non-financial KPIs. Print up an executive summary, create sharable PDFs including visual graphs and charts, or even provide benchmarking with up to 20 organizations.

10. VATBox

International expense reconciliation can be a nightmare, and a failure to track and claim back foreign taxes can be a big drain on a budget. VATBox fully automates the VAT recovery process. They quickly and accurately extract data with their patented visual recognition system. It verifies expenses in real time and makes sure that all receipts have the needed information. The smart dashboard lets you see important metrics at a glance, including potential reclaim amounts, the gaps between your potential and actual VAT returns. and the reasons for those gaps.

Freed up by the power of mobile, highly collaborative cloud based software, both CFOs and CPAs are now taking on increasingly strategic and analytic roles, and the benefits in terms of both . From simple bookkeeping and timesheet management to complex financial forecasting which draws on the rich stream of Big Data, these tools are transforming the way SMBs deal with the bottom line.

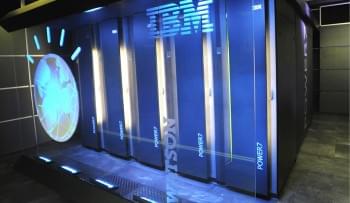

[Image via Shutterstock]